Ulster County Property Appraiser

Real Property Tax Service Agency - Ulster County

Phone Fax (845) 340-3499 Location Real Property Tax Service Agency 244 Fair Street, PO Box 1800 Kingston, NY 12401 View Map Hours - Sunday Closed - Monday - Tuesday - Wednesday - Thursday - Friday - Saturday Closed...

https://www.ulstercountyny.gov/Departments/Finance/Real-Property

Ulster County 2026 Budget Approved by County Legislature - Ulster County

The Ulster County Legislature voted on Wednesday to approve the 2026 Executive Budget with amendments — advancing County Executive Jen Metzger’s proposed investments to address food and housing insecurity, strengthen emergency medical response, improve public transit and infrastructure, and protect the environment, all while keeping property taxes flat.

https://www.ulstercountyny.gov/Government/News/Newsroom/2025/12/2025-12-4-2026-Budget-Approved

Almost half of Ulster County taxpayers will see their ...

Ulster County property tax rates for 2026 will be as follows: • Denning: $17.92 per $1,000 of assessed property value, up from the $16.46 per ...

https://www.dailyfreeman.com/2025/12/22/almost-half-of-ulster-county-taxpayers-will-see-their-property-taxes-rise/And the 2026 Ulster County... - Ulster County Executive | Facebook

A special thanks to our great Budget team: Budget Director Ken Juras, Deputy Budget Directors Don Quesnell and Victoria Reid (not pictured), Budget Analyst Carolyn Rink, Confidential Secretary to the Budget Director Natasha Tagliafierro, and our grants team (not pictured), Fiona Bohan and Noah-Lee Andre.

https://www.facebook.com/UlsterCountyExecutive/posts/and-the-2026-ulster-county-budget-is-signed-keeping-taxes-flata-special-thanks-t/1426895589102300/

Ulster County budget proposal avoids property tax hike

Ulster County Executive Jen Metzger has released her proposed 2026 budget, which includes no property tax increase.

https://spectrumlocalnews.com/nys/hudson-valley/news/2025/10/06/ulster-county-2026-budget-proposalTax Information - Ulster County

Tax Information Property Tax Information Property owners typically receive two tax bills a year. General tax bills, which include County, City or Town, and Special District Taxes, are sent in January. School Tax bills are sent in September. Residents of the villages of Ellenville, New Paltz, and Saugerties also receive a village tax bill in June.

https://www.ulstercountyny.gov/Departments/Finance/Tax-Information

Ulster County, NY Property Tax Calculator 2025-2026

Calculate Your Ulster County Property Taxes Ulster County Tax Information How are Property Taxes Calculated in Ulster County? Property taxes in Ulster County, New York are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 2.12% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/newyork/ulster-county

Ulster County Property Tax Grievance | Aventine Properties

Permanent Tax Savings Ongoing property tax reduction benefit year after year until a town wide reassessment happens. No Upfront Fees You only pay if we obtain a reduction on your assessment. File with us with no payment required! No Downside or Risk Your property assessment can only be reduced.

https://aventineproperties.com/ulster-county-tax-grievance/

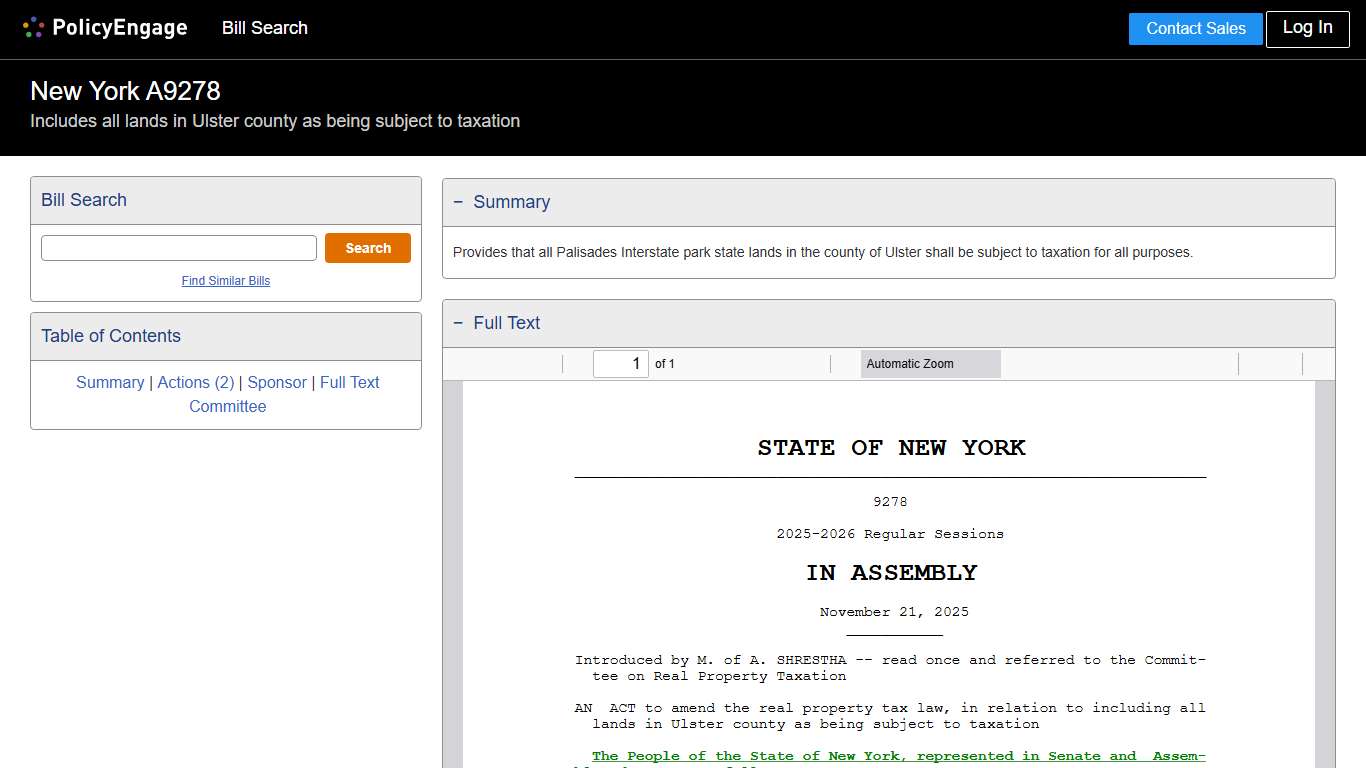

A9278 | New York 2025-2026 | Includes all lands in Ulster county as being subject to taxation - Legislative Tracking | PolicyEngage

− Summary Provides that all Palisades Interstate park state lands in the county of Ulster shall be subject to taxation for all purposes. − Full Text − Actions (2) On January 7, 2026 in the Assembly: - Referred To Real Property Taxation On November 21, 2025 in the Assembly: - Referred To Real Property Taxation...

https://trackbill.com/bill/new-york-assembly-bill-9278-includes-all-lands-in-ulster-county-as-being-subject-to-taxation/2750934/

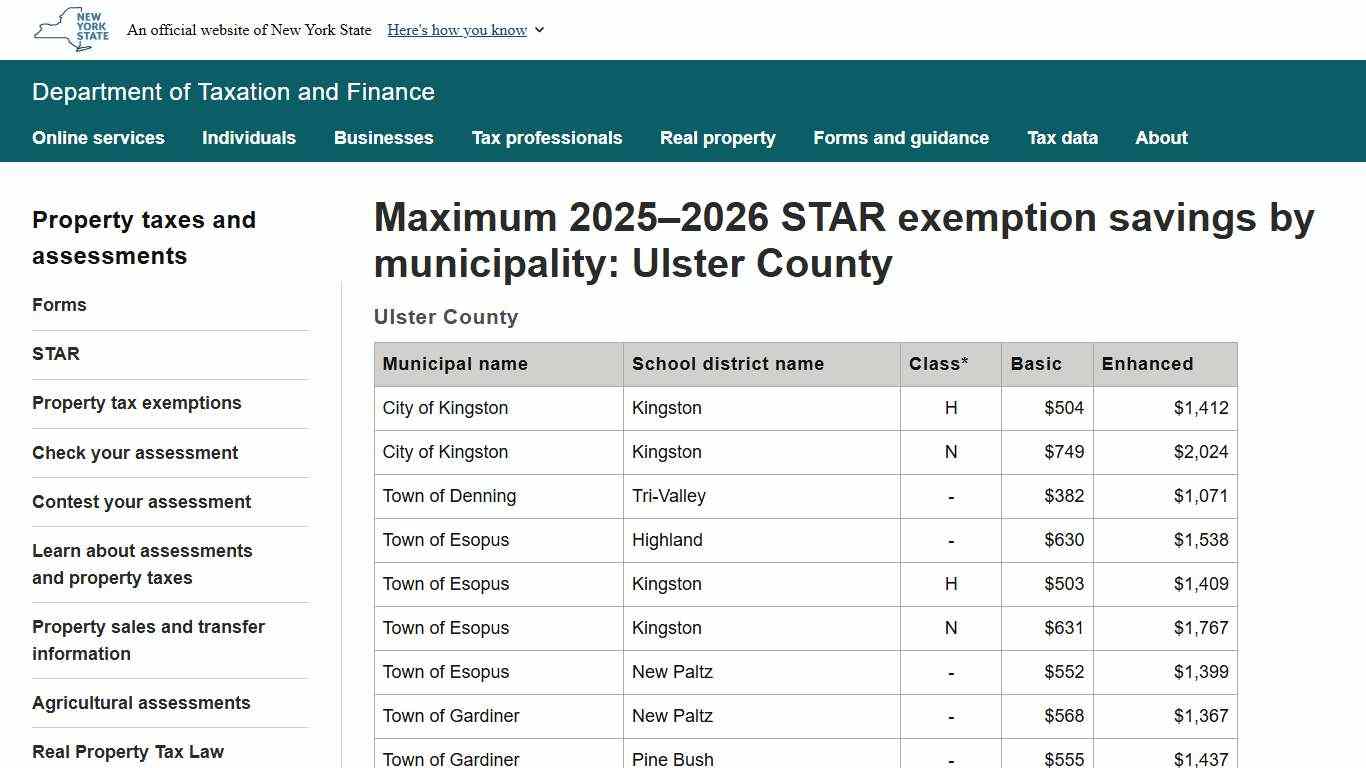

Maximum 2025–2026 STAR exemption savings by municipality: Ulster County

Maximum 2025–2026 STAR exemption savings by municipality: Ulster County * Class refers only to school districts that exercise the homestead/non-homestead tax option, or that are based within special assessing units (Nassau County or NYC). Page last reviewed or updated:...

https://www.tax.ny.gov/pit/property/star/max-savings/municipality/muni51.htm

Ulster County, NY - SearchIQS

See Subscription Plans/Create an Account...

https://www.searchiqs.com/NYULS/

Assessment Rolls - Ulster County

Listing of the assessed value of every property in the County. Assessments are made by municipal assessors and used to calculate property taxes.

https://www.ulstercountyny.gov/Departments/Finance/Real-Property/Assessments/Assessment-Rolls

Ulster County, NY Property Records Search - Propertyscout.io

Leading companies trust PropertyScout.io Search over 140 Million Property Tax Records in the U.S. Title Record Search Quickly find detailed title records. Search by address, neighborhood, city, ZIP code, or parcel number and instantly download the property title report. Deed Search Access deed records effortlessly.

https://propertyscout.io/ny/ulster-county-property-tax-records/

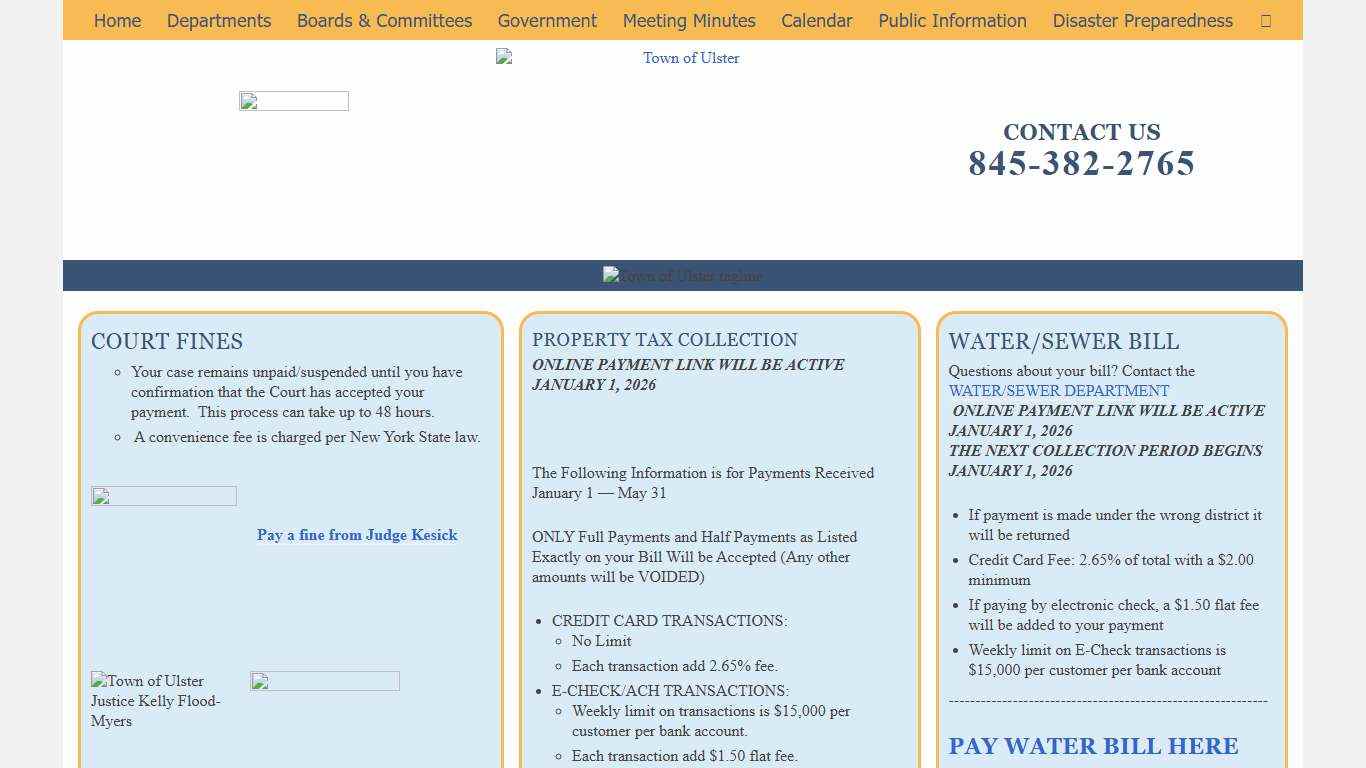

Town of Ulster | Make Payments Online | Water | Court | Taxes

COURT FINES - - Your case remains unpaid/suspended until you have confirmation that the Court has accepted your payment. This process can take up to 48 hours. - A convenience fee is charged per New York State law. PROPERTY TAX COLLECTION ONLINE PAYMENT LINK WILL BE ACTIVE JANUARY 1, 2026 The Following Information is for Payments Received January 1 — May 31 ONLY Full Payments and Half Payments as Listed...

https://www.townofulster.ny.gov/online-payments/

Bill Text: NY A07922 | 2025-2026 | General Assembly | Introduced | LegiScan

Bill Text: NY A07922 | 2025-2026 | General Assembly | Introduced Bill Title: Establishes a community housing fund in the town of Rochester, county of Ulster, to provide housing opportunities for its residents. Spectrum: Partisan Bill (Republican 1) Status: (Introduced) 2026-01-07 - referred to local governments [A07922 Detail] Download: New_York-2025-A07922-Introduced.html STATE OF NEW YORK _____________________________________________________...

https://legiscan.com/NY/text/A07922/2025